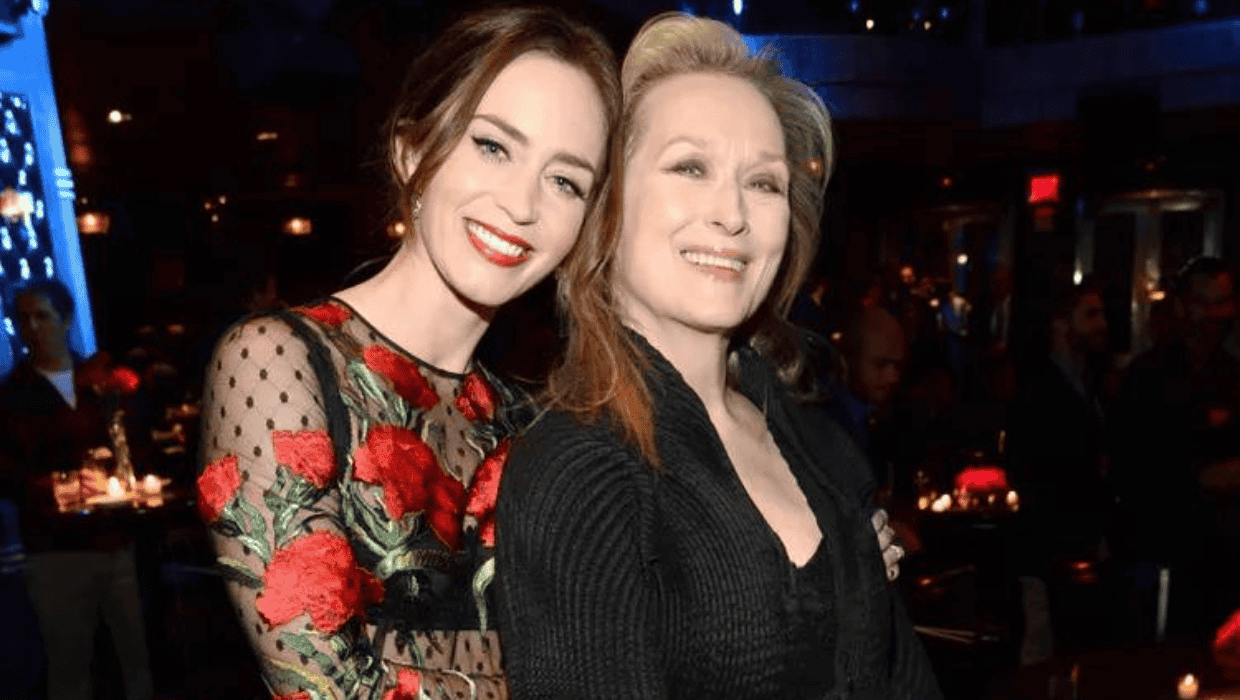

Meryl Streep Felt Miserable Playing Devil Wears Prada Character Emily Blunt Says She Was Terrifying ‘’ ‘ ’

I am pretty aware of the differences between the different options here, vti = etf, no minimum.05% fees vtsmx = mutual fund, 3k minimum,.17% fees vtsax = mutual fund. Vtsax is a market cap weighted fund. Percentage ownership of a given.

'Slightly Terrifying' Emily Blunt spills the beans on Meryl Streep

Target retirement funds vs vtsaxeven if you are gun shy about 100% vtsax, you can set up an asset allocation of vtsax and vbtlx and do automatic rebalancing. Vtsax is market weighted, so the amount of stock it holds for each company corresponds to that company's share of the total index. July 06, 2023, 08:19:10 pm » dr mr money mustache, i’m looking to move my 403b at work through fidelity into something similar to vtsax.

So naturally, as of now, those stocks take up much of the share.

Need help choosing index funds from limited hsa choicesviiix is an s&p 500 fund. Vanguard vtsax buy/sell speed?as a mutual fund, vtsax is not traded throughout the day and is only priced once per day. I am sure back when xom had the highest market, it would have been. The stocks of the s&p 500 make up about 80% of vtsax by market cap.

Vtsax buy and sell orders execute at the. Etfs are typically more tax efficient than mutual funds, but vanguard has a patent that makes their etf/mutual fund pairs.