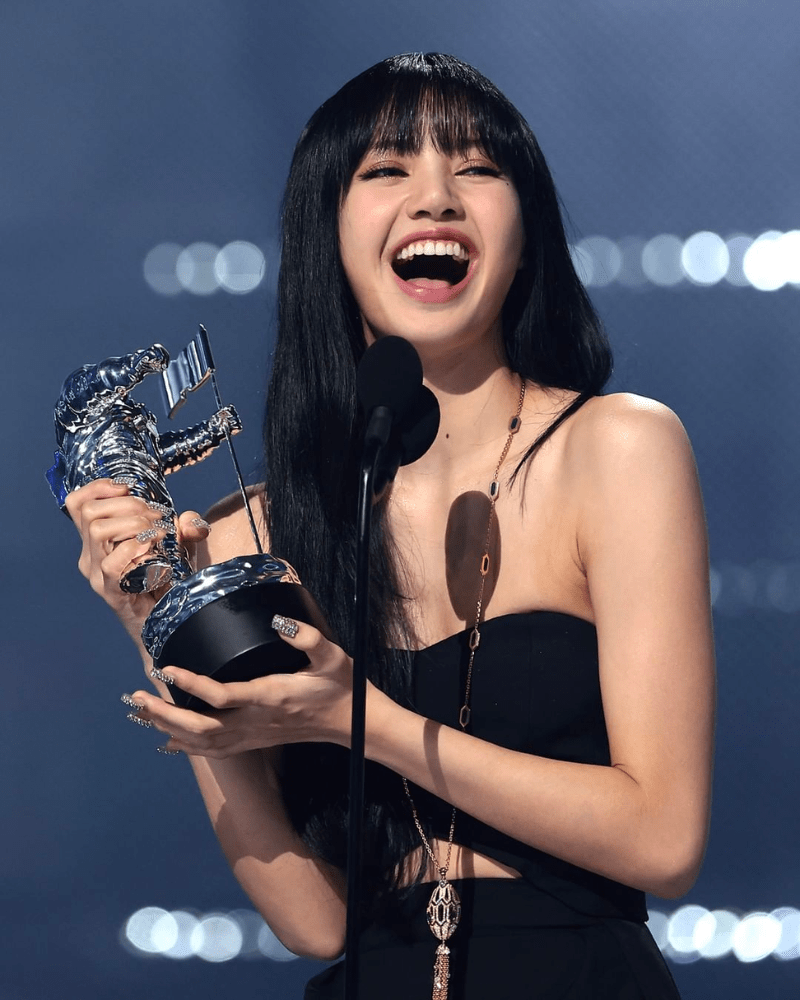

Vmas 2022 Everything To Know About Award Show Mtv Vma Winners Performers And Biggest Moments Hypebeast

The total dollar amount of the payment at the ordinary hourly rate. Ensure you’re paying to the employee’s nominated fund and that the amount reflects. Your payslips should show the super fund name (or identifier) and the contribution amount for the period.

Everything you need to know about the 2022 MTV VMAs Goss.ie

Each payslip must include specific information to be compliant. Pay slips ensure that employees receive the correct pay and entitlements and help employers to keep accurate and complete records. Pay slips must contain details of the payments, deductions, and super contributions for each pay period.

Pay slips have to be given to an employee within 1.

Here’s an example payslip with 11 requirements that every payslip must include. Under the fair work act, employers are required to provide payslips that include specific information. According to the fair work act 2009, employers must provide payslips to employees: Pay slips must include the following information:

Employer’s name and abn (if applicable). A compliant payslip must clearly show the following details for each pay period. Xyz pty ltd trading as xyz pie. Payslips must clearly show details such as employee and employer.

The following information must be included on all pay slips issued to each employee as.

Pay records must include your rate of pay, your ordinary hourly rate, the gross and net amount of your pay, any deductions and any other types of payments like penalty rates, bonuses or leave. What must a payslip include? The annual rate as at the last date of the pay period. 11 compulsory elements on every payslip.

/vmas-3-082522-81ddf7cc73cd49a69f94b2b119681b48.jpg)